48K After Tax

The concept of "48K After Tax" refers to an individual's take-home pay, which is the amount of money they receive after taxes and other deductions have been subtracted from their gross income. In this case, the take-home pay is £48,000 per annum. To understand the implications of this figure, it's essential to consider the various factors that affect an individual's net income, including tax rates, deductions, and personal circumstances.

Understanding Tax Rates and Deductions

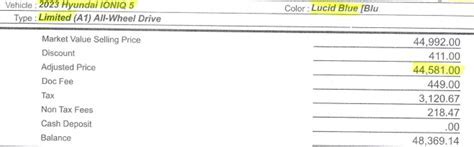

In the United Kingdom, income tax is calculated based on an individual’s taxable income, which is their gross income minus any tax-free allowances and deductions. The tax rates and bands in the UK are as follows: Basic Rate (20%) on taxable income up to £50,000, Higher Rate (40%) on taxable income between £50,001 and £150,000, and Additional Rate (45%) on taxable income above £150,000. An individual with a gross income that results in a take-home pay of £48,000 after tax would likely be paying the Basic Rate of income tax.

Tax-Free Allowances and Deductions

Tax-free allowances, such as the Personal Allowance, can significantly impact an individual’s net income. The Personal Allowance in the UK is £12,570 for the 2022-2023 tax year, meaning that the first £12,570 of an individual’s income is tax-free. Other deductions, such as pension contributions, student loan repayments, and charitable donations, can also reduce an individual’s taxable income. For example, if an individual contributes 5% of their gross income to a pension scheme, this amount would be deducted from their taxable income, reducing the amount of income tax they pay.

| Taxable Income | Tax Rate | Tax Payable |

|---|---|---|

| £0 - £12,570 | 0% | £0 |

| £12,571 - £50,000 | 20% | £7,486 |

| £50,001 - £150,000 | 40% | £40,000 |

| £150,001 and above | 45% | £60,000 |

Net Income and Spending Power

An individual’s net income, or take-home pay, is a critical factor in determining their spending power. With a take-home pay of £48,000, an individual would have a significant amount of disposable income to allocate towards living expenses, savings, and debt repayment. According to the UK’s Office for National Statistics (ONS), the average household expenditure in the UK is around £30,000 per annum, leaving an individual with a take-home pay of £48,000 with a substantial amount of disposable income.

Allocating Disposable Income

It’s crucial for individuals to allocate their disposable income effectively to achieve their financial goals. A general rule of thumb is to allocate 50% of net income towards necessary expenses, such as rent/mortgage, utilities, and food, 30% towards discretionary spending, and 20% towards saving and debt repayment. With a take-home pay of £48,000, an individual could potentially allocate £24,000 towards necessary expenses, £14,400 towards discretionary spending, and £9,600 towards saving and debt repayment.

- Necessary expenses: £24,000 (50% of net income)

- Discretionary spending: £14,400 (30% of net income)

- Saving and debt repayment: £9,600 (20% of net income)

How does tax affect my take-home pay?

+Tax deductions can significantly reduce your take-home pay. Understanding tax rates and deductions is essential to maximizing your net income. For example, if you contribute to a pension scheme, this amount would be deducted from your taxable income, reducing the amount of income tax you pay.

How can I allocate my disposable income effectively?

+Allocating your disposable income effectively is crucial to achieving your financial goals. Consider allocating 50% of your net income towards necessary expenses, 30% towards discretionary spending, and 20% towards saving and debt repayment. Review and adjust your budget regularly to ensure you're on track to meet your financial objectives.

In conclusion, understanding the concept of “48K After Tax” requires considering various factors, including tax rates, deductions, and personal circumstances. By grasping these concepts, individuals can make informed decisions about their financial planning, allocate their disposable income effectively, and achieve their financial goals.