Affidavit Expense Report: Simplify Claims

An affidavit expense report is a document used to itemize and verify expenses related to a specific event, project, or activity. It is often used in legal, business, and professional settings to simplify claims and provide a clear record of expenditures. The purpose of an affidavit expense report is to provide a detailed and accurate account of expenses, making it easier to process reimbursements, settlements, or other financial transactions.

Key Components of an Affidavit Expense Report

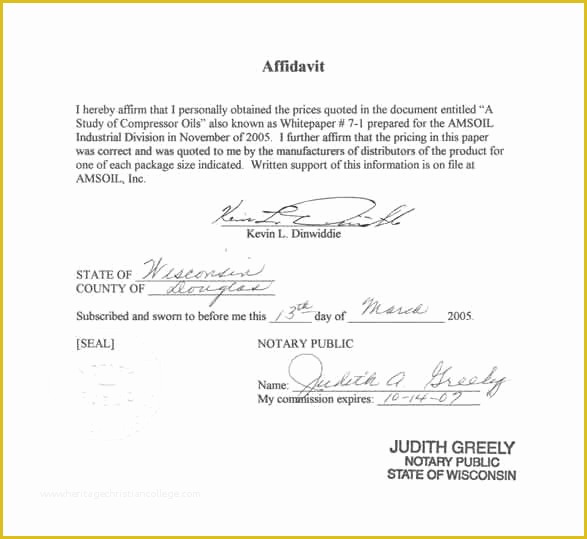

A comprehensive affidavit expense report should include the following key components: date and time of the expense, description of the expense, amount of the expense, and receipts or supporting documentation. These components help to ensure that the report is accurate, complete, and easy to understand. Additionally, the report should be notarized to verify the authenticity of the information provided.

Benefits of Using an Affidavit Expense Report

The use of an affidavit expense report offers several benefits, including increased transparency, improved accountability, and reduced disputes. By providing a detailed and accurate record of expenses, individuals and organizations can avoid misunderstandings and ensure that expenses are properly reimbursed or settled. Furthermore, an affidavit expense report can help to streamline the reimbursement process, making it easier to manage finances and track expenses.

| Component | Description |

|---|---|

| Date and Time | The date and time of the expense, including the date and time of purchase or payment. |

| Expense Description | A detailed description of the expense, including the type of expense, the purpose of the expense, and any relevant details. |

| Amount | The total amount of the expense, including any taxes, fees, or other charges. |

| Receipts and Supporting Documentation | Copies of receipts, invoices, and other supporting documentation to verify the expense. |

Best Practices for Completing an Affidavit Expense Report

To ensure that an affidavit expense report is accurate and effective, it is essential to follow best practices, including keeping detailed records, verifying information, and submitting the report in a timely manner. Additionally, individuals and organizations should review and update their expense reporting policies regularly to ensure that they are compliant with relevant laws and regulations.

Common Challenges and Solutions

One of the common challenges associated with affidavit expense reports is lost or missing receipts. To overcome this challenge, individuals and organizations can use digital receipt systems or expense tracking software to record and store receipts electronically. Another challenge is inaccurate or incomplete information, which can be addressed by verifying information and double-checking calculations before submitting the report.

- Detailed records: Keep detailed records of expenses, including receipts, invoices, and other supporting documentation.

- Verification: Verify information and calculations before submitting the report.

- Timely submission: Submit the report in a timely manner to ensure that expenses are properly reimbursed or settled.

What is the purpose of an affidavit expense report?

+The purpose of an affidavit expense report is to provide a detailed and accurate account of expenses, making it easier to process reimbursements, settlements, or other financial transactions.

What are the key components of an affidavit expense report?

+The key components of an affidavit expense report include date and time of the expense, description of the expense, amount of the expense, and receipts or supporting documentation.

How can I ensure that my affidavit expense report is accurate and effective?

+To ensure that your affidavit expense report is accurate and effective, follow best practices, including keeping detailed records, verifying information, and submitting the report in a timely manner.