Cit Bank Guide: Ryan Perea's Investment Strategies

CIT Bank, a subsidiary of CIT Group Inc., is a leading online bank that offers a range of savings products and investment options. For investors looking to grow their wealth, understanding the bank's features and benefits is crucial. Ryan Perea, a financial expert, has shared his investment strategies that can help individuals make the most of CIT Bank's offerings. In this guide, we will delve into Perea's investment approaches and explore how they can be applied to CIT Bank's products.

Understanding CIT Bank’s Products

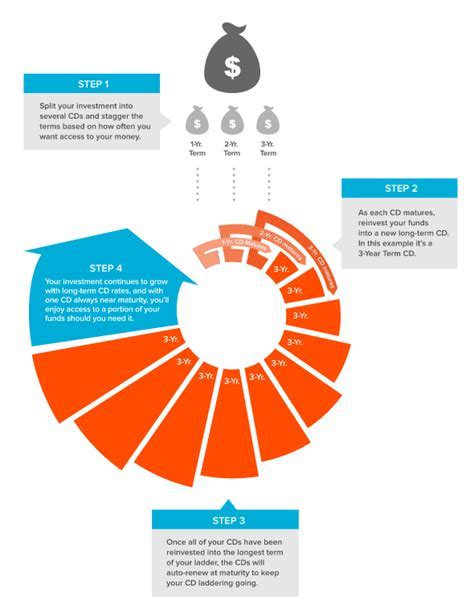

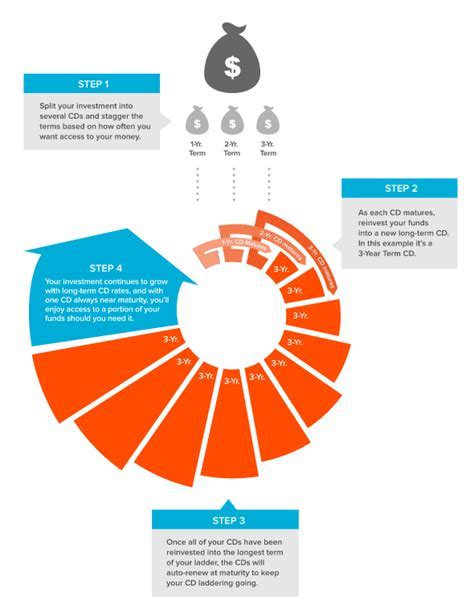

CIT Bank offers a variety of savings products, including high-yield savings accounts, certificates of deposit (CDs), and money market accounts. These products are designed to provide investors with low-risk investment options that can help them grow their wealth over time. High-yield savings accounts, for example, offer competitive interest rates that can help investors earn more than traditional savings accounts. Certificates of deposit, on the other hand, provide a fixed interest rate for a specified period, making them a great option for those who want to lock in a rate for a longer term.

Ryan Perea’s Investment Strategies

Ryan Perea’s investment strategies focus on diversification, risk management, and long-term growth. He recommends that investors allocate their portfolios across different asset classes, including low-risk savings products, stocks, and bonds. By diversifying their portfolios, investors can reduce their risk and increase their potential for long-term returns. Perea also emphasizes the importance of emergency funds, which can provide a cushion in case of unexpected expenses or market downturns.

| Product | Interest Rate | Minimum Deposit |

|---|---|---|

| High-Yield Savings Account | 1.75% APY | $100 |

| Certificate of Deposit (CD) | 2.50% APY | $1,000 |

| Money Market Account | 1.50% APY | $100 |

Applying Perea’s Strategies to CIT Bank’s Products

Investors can apply Perea’s investment strategies to CIT Bank’s products by allocating their portfolios across different asset classes. For example, they can invest in a high-yield savings account for their emergency fund, while also investing in a certificate of deposit for a longer-term investment. Money market accounts can also be used to park excess funds, earning a competitive interest rate while maintaining liquidity.

Benefits of CIT Bank’s Products

CIT Bank’s products offer several benefits, including competitive interest rates, low fees, and FDIC insurance. The bank’s online platform also provides investors with easy access to their accounts, allowing them to manage their investments and track their progress. Additionally, CIT Bank’s products are designed to be low-risk, making them a great option for investors who are looking for stable returns.

- Competitive interest rates: CIT Bank's products offer some of the highest interest rates in the industry, helping investors earn more on their savings.

- Low fees: CIT Bank's products have low or no fees, making it easier for investors to keep their costs down.

- FDIC insurance: CIT Bank's products are insured by the FDIC, providing investors with an added layer of protection.

What is the minimum deposit required to open a CIT Bank account?

+The minimum deposit required to open a CIT Bank account varies depending on the product. For example, the high-yield savings account requires a minimum deposit of $100, while the certificate of deposit requires a minimum deposit of $1,000.

Are CIT Bank's products insured by the FDIC?

+Yes, CIT Bank's products are insured by the FDIC, providing investors with an added layer of protection. The FDIC insures deposits up to $250,000 per depositor, per insured bank.

In conclusion, Ryan Perea’s investment strategies can be applied to CIT Bank’s products to help investors grow their wealth over time. By allocating their portfolios across different asset classes and taking advantage of CIT Bank’s competitive interest rates and low fees, investors can achieve their long-term financial goals. Whether you’re looking to build an emergency fund or invest for the long-term, CIT Bank’s products can provide a solid foundation for your investment portfolio.