Does Sofi Have Mpower

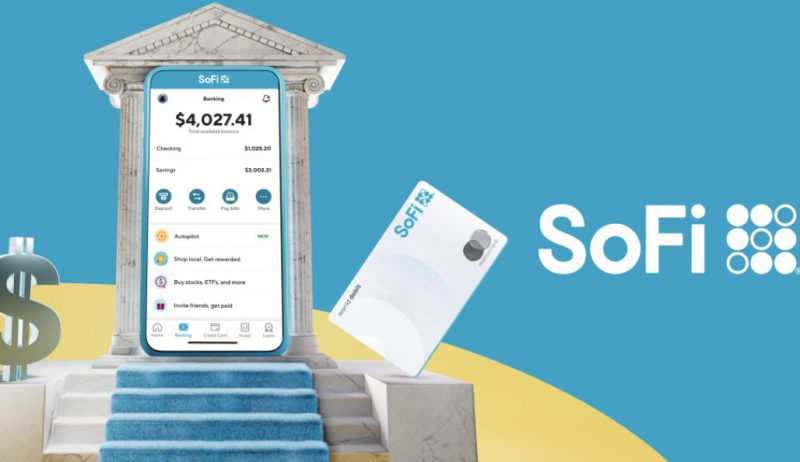

Sofi, a financial services company, has undergone significant transformations and expansions in its offerings over the years. One of the key areas of focus for Sofi has been providing its members with a wide range of financial tools and services aimed at empowering them to manage their finances more effectively. The concept of "Mpower" can be interpreted in several ways, including financial empowerment, member benefits, and access to exclusive financial products. In the context of Sofi, understanding whether Sofi has "Mpower" involves examining its capabilities, services, and the value it offers to its members.

Understanding Sofi’s Capabilities

Sofi is known for its comprehensive suite of financial products and services, which include personal loans, mortgages, credit cards, investment products, and banking services. By offering these services, Sofi aims to provide its members with the tools they need to achieve financial stability and growth. This can be seen as a form of financial empowerment, where members have access to a variety of financial instruments tailored to their needs, thereby enhancing their financial capabilities.

Financial Empowerment through Education and Resources

Another aspect of “Mpower” could be the provision of educational resources and financial literacy tools. Sofi invests in educating its members through various platforms, including webinars, blogs, and financial guides. By equipping its members with knowledge on personal finance, investing, and money management, Sofi empowers them to make informed financial decisions. This educational aspect is crucial in the financial empowerment of individuals, allowing them to navigate complex financial markets and products with confidence.

| Service | Description |

|---|---|

| Personal Loans | Offering competitive rates for debt consolidation, large purchases, and more |

| Mortgages | Providing mortgage options with competitive rates and terms |

| Credit Cards | Issuing credit cards with rewards, low APRs, and no foreign transaction fees |

| Investment Products | Offering brokerage services and retirement accounts with low fees |

| Banking Services | Providing checking and savings accounts with high-yield interest rates and low fees |

Member Benefits and Exclusive Products

Beyond the standard financial products, Sofi also offers its members exclusive benefits and products designed to enhance their financial experience. These can include unemployment protection, career counseling services, and access to exclusive events and webinars. Such benefits can be seen as a manifestation of “Mpower,” where members feel supported not just in their financial decisions but also in their career and personal growth.

Access to Financial Experts and Community

Sofi facilitates access to financial experts and a community of like-minded individuals. This access can be invaluable for members seeking personalized advice or looking to learn from the experiences of others. By fostering a sense of community and providing access to expert knowledge, Sofi further empowers its members to achieve their financial goals.

In conclusion, Sofi's commitment to providing a wide array of financial services, educational resources, and exclusive member benefits aligns with the concept of "Mpower." By empowering its members financially, Sofi plays a significant role in helping individuals achieve financial stability, grow their wealth, and navigate the complexities of personal finance with confidence.

What kinds of financial products does Sofi offer?

+Sofi offers a variety of financial products, including personal loans, mortgages, credit cards, investment products, and banking services. Each product is designed to cater to different financial needs, from debt consolidation and large purchases to investing and daily banking.

How does Sofi empower its members financially?

+Sofi empowers its members financially through access to competitive financial products, educational resources, and exclusive benefits. By combining these elements, Sofi aims to enhance the financial well-being of its members, enabling them to make informed decisions and achieve their financial goals.