What Is Bca Model 201? Simplified Guide

The BCA Model 201 is a complex and multifaceted concept that has garnered significant attention in various fields, particularly in the realm of business and economics. To provide a comprehensive understanding of this model, it is essential to delve into its core components, applications, and implications. In this simplified guide, we will navigate the intricacies of the BCA Model 201, exploring its definition, key elements, and practical applications.

Introduction to BCA Model 201

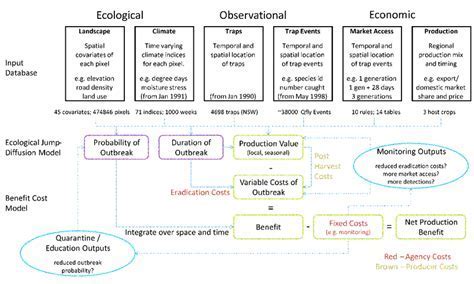

The BCA Model 201, also known as the Business Cycle Accounting model, is an economic framework designed to analyze and understand the fluctuations in economic activity. This model is an extension of the traditional business cycle theory, which posits that economic activity is influenced by a combination of factors, including technological shocks, monetary policy, and fiscal policy. The BCA Model 201 provides a more nuanced and detailed explanation of the business cycle, incorporating various economic indicators and variables to forecast and analyze economic trends.

Key Components of BCA Model 201

The BCA Model 201 consists of several key components, including:

- Technological Shocks: Refers to the unexpected changes in technology that can impact productivity and economic growth.

- Monetary Policy: Involves the actions taken by central banks to regulate the money supply and interest rates, influencing economic activity.

- Fiscal Policy: Encompasses the government’s decisions regarding taxation and public expenditure, which can affect aggregate demand and economic growth.

- Frictional unemployment: Represents the unemployment that arises due to the time and resources required for workers to transition between jobs.

These components interact and influence one another, resulting in complex and dynamic economic fluctuations. The BCA Model 201 provides a framework for understanding and analyzing these interactions, allowing economists and policymakers to better forecast and respond to economic trends.

| Component | Description |

|---|---|

| Technological Shocks | Unexpected changes in technology affecting productivity and growth |

| Monetary Policy | Central bank actions regulating money supply and interest rates |

| Fiscal Policy | Government decisions on taxation and public expenditure |

Applications of BCA Model 201

The BCA Model 201 has various applications in fields such as economics, finance, and business. Some of the key applications include:

- Economic Forecasting: The model can be used to forecast economic trends and fluctuations, allowing businesses and policymakers to make informed decisions.

- Policy Development: The BCA Model 201 provides a framework for policymakers to analyze the impact of different policy interventions, such as monetary and fiscal policy, on the economy.

- Business Strategy: Companies can use the model to understand the economic environment and make strategic decisions regarding investment, production, and pricing.

By applying the BCA Model 201, economists and businesses can gain valuable insights into the complex interactions driving economic fluctuations, ultimately leading to more informed decision-making and effective policy development.

Limitations and Criticisms of BCA Model 201

While the BCA Model 201 has been widely praised for its contributions to our understanding of economic fluctuations, it is not without its limitations and criticisms. Some of the key limitations include:

- Simplifying Assumptions: The model relies on simplifying assumptions, which may not accurately capture the complexity of real-world economic systems.

- Lack of Microfoundations: The BCA Model 201 has been criticized for lacking microfoundations, which can limit its ability to explain the behavior of individual economic agents.

- Parameter Estimation: The model requires the estimation of various parameters, which can be challenging and subject to significant uncertainty.

Despite these limitations, the BCA Model 201 remains a widely used and influential framework in the field of economics, providing valuable insights into the complex dynamics driving economic fluctuations.

What is the primary purpose of the BCA Model 201?

+The primary purpose of the BCA Model 201 is to provide a framework for understanding and analyzing economic fluctuations, allowing economists and policymakers to better forecast and respond to economic trends.

What are the key components of the BCA Model 201?

+The key components of the BCA Model 201 include technological shocks, monetary policy, fiscal policy, and frictional unemployment. These components interact and influence one another, resulting in complex and dynamic economic fluctuations.

In conclusion, the BCA Model 201 is a complex and multifaceted framework that has significantly advanced our understanding of economic fluctuations. By providing a nuanced and detailed explanation of the business cycle, the model has enabled economists and policymakers to make more informed decisions and develop effective policies. While the model has its limitations and criticisms, it remains a widely used and influential framework in the field of economics, offering valuable insights into the complex dynamics driving economic trends.